Good balance is important in today’s uncertain economic environment. Most investors would agree, considering the state of the pandemic, economic changes, and massive monetary and central bank response - we are not living in normal times.

Most investors also believe that they own a well-balanced portfolio, after all, the portfolio says ‘balanced’ in the name, so it must be true? Hence investors believe that they are appropriately positioned for the present and future uncertainties. However, in this week’s letter, I explain that there is a disconnect between what you think and what is the reality. You think that your portfolio is well balanced, but it is not.

What is good balance?

Let’s first define what it means to have good balance. From my perspective, achieving a good balance in your investment portfolio means that the return you get should be as steady as possible with minimal fluctuations over time. To illustrate, consider the following two portfolios:

You might ask, if the two portfolios produced the same return over the same time period, then why should I care which one I own? The reason has to do with the sequence of returns and the risk of investing at an inopportune time. In the above example, imagine that you had a 15-year time horizon to invest your money, which most of us would agree is long-term. If you invested in the first 15-year period, then you would have been very happy with Portfolio A. However, if you invested in the latter 15-year period, then you would have been very unhappy. This is what we call timing risk and it is a risk that all investors are living with every day with their investment portfolios.

Compare the timing risk of Portfolio A versus Portfolio B, which achieved the same compound return over the thirty-year period; Portfolio B is clearly superior. Portfolio B was able to achieve a tighter range of returns around the compound average return. Portfolio B’s asset allocation is clearly better balanced since the odds of earning close to the average return are substantially better than in Portfolio A. Even if you started investing in the wrong period, you would have still achieved success with Portfolio B.

These two examples may sound unrealistic, and you might think, in real life the outcomes cannot be that spread out. Fifteen years is a long period, and normally bad periods are followed by good periods, so a “normal” return of 6-8 per cent for a balanced portfolio is more likely. Although this may sound reasonable, it’s not reality and is not supported by historical results. Let me illustrate:

Materially different

A 60% equity and 40% fixed income portfolio has long been considered a “balanced portfolio” by most investors. The “balance” comes from owning equities and bonds, two asset classes that are materially different from one another. Equities, which are highly volatile, offer attractive long-term expected returns, while bonds (or fixed income) provide stability and lower the volatility of the overall portfolio.

Conventional thinking is that bonds generate lower returns but are needed to lower the variability of returns, and equities are too volatile for most people to own on their own. Taking this thinking further, if an investor has a longer time horizon, then they should own more equities than bonds as long as they have the patience, risk tolerance and time horizon to hold on during difficult market environments. This kind of conventional thinking is popularized by books such as Stocks for the Long Run by Jeremy Siegel. The problem with this thinking is that the 60/40 portfolio is not only imbalanced, but is exceedingly out of balance and more akin to the example described with Portfolio A.

The 60/40 portfolio

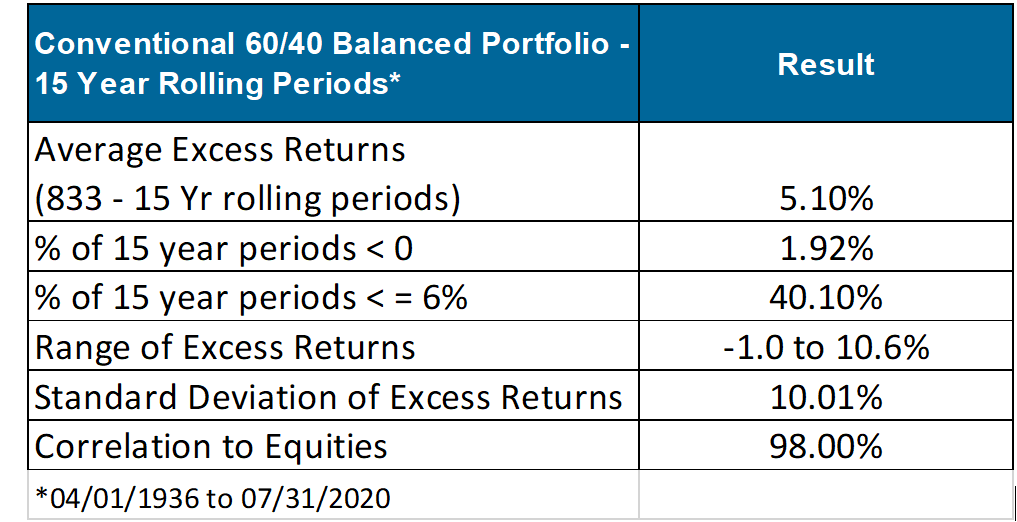

As an investor, you recognize that equities are volatile and it may be the reason you picked a balanced portfolio. So, you may ask, why is it that a 60/40 portfolio is unbalanced? Well the short answer: the total return of a balanced portfolio is almost entirely dependent on whether stocks have performed above or below their average returns. Since bond returns are not very volatile, they have little impact on the total portfolio return. A poor returning period for bonds is not far from its average, just as a good period is not that far above it. Since equities are more volatile than fixed income, the total portfolio’s success is dependent upon the return of the stocks. In portfolio construction, the more volatile asset should have a lower weight (to make up for the fact that it is more volatile), and the less volatile asset class should have a higher weight (so that its impact on the portfolio matches that of the higher volatility asset class). The reality is that the traditional 60/40 portfolio is 98 per cent correlated to the equity market. This is an observation I’ve made over short and long term periods, looking at a dataset from April 1936 (84 years). As a result of this imbalance, a 60/40 portfolio can go through very long periods of underperformance compared to pure equity returns.

However, we aren’t done yet. We have only considered volatility and the resulting variability of returns as the first reason why a 60/40 portfolio is imbalanced. The secondary reason has to do with the fact that the 60/40 asset allocation completely ignores the economic bias inherent in equities and fixed income. For instance, both equities and bonds are biased to do well when inflation falls and poorly when inflation rises.

Historical trends

If economic growth unexpectedly slows, then stocks are biased to perform poorly. The greater the shortfall between actual growth and what had been expected, the greater the decline in stock prices. A clear example is what happened in 2008 or 2020. The stock market collapsed largely because investors were expecting growth in 2008 to look like 2007 and in 2020 to look like 2019. Instead, economic conditions today more closely resemble those from 1931! Falling inflation provides a tailwind for stock prices because of falling interest rates. As expected, the opposite growth and inflation outcomes produce the opposite effect.

The same analysis can be performed for every asset class. Each has a certain bias toward rising or falling growth and rising or falling inflation climates. Moreover, these economic environments can last for short periods (months) or persist even longer (years or decades). Case in point, inflation was rising from the late 1960s to the early 1980s and resulted in significant underperformance for equities for over a decade. Similarly, 2000 to 2014 was a period during which economic growth was significantly below trend coming out of the Internet boom and, therefore, resulted in a 15-year period during which stocks severely underperformed their average historical returns.

Conclusion

Whatever the economic climate or time period, you need to ensure that your portfolio is set up for success and effectively balanced across more than just equities and bonds when you are investing for the long term.

The future, as we know, is fraught with unknowns that can easily derail our well laid financial plans. Perhaps most investors and investment professionals believe that there is nothing that you can do to minimize a portfolio’s volatility of returns. I believe that this conclusion is entirely incorrect and is the result of conventional thinking. So, delivering conventional returns will likely prevail in our industry and other unconventional approaches will be relegated to investors who have a broader view of risk and return.

Being different can be highly rewarding over the long run, but will pose challenges over short periods of time because of the dissimilar return pattern from the conventional portfolio. Each investor has to decide what is best for their individual risk and return objectives. At Counsel Portfolio Services and Investment Planning Counsel, we will continue to provide investors with solutions that meet their investment needs and desires, whether they be conventional or unconventional 60/40 portfolios.

Until next time, stay safe and be well.

Corrado Tiralongo

Chief Investment Officer

Counsel Portfolio Services | IPC Private Wealth

Click Here to Read Our Forward-Looking Statements Disclaimer