My week started with the following family conversation.

Me: Hi Dad (I call my in-laws Mom and Dad out of respect), Happy Birthday!

Dad: Thanks. You know I lost $300,000 last week.

Me: Yes Dad, we talked about this last week. I know it is a lot of money, but it will be alright. Your portfolio is mostly in high quality corporate bonds; they will be fine. There is just a lot of uncertainty in the market. You don’t need to sell them. They will come back in price and, in fact, probably appreciate given that interest rates have fallen. In fact, you might want to think about buying some equity. Not a lot, but there are some great companies that are trading at really good values.

Dad: I don’t want to lose more money

Me: I know Dad, but this downturn is temporary. You need to think about five years from now, not the next six–12 months.

Dad: I’ll think about it.

We leave it at that.

Yet again, I was unsuccessful at convincing my in-laws. Perhaps I’m not cut out to be a personal financial advisor, so I think I’ll stick to my day job.

As I think about this, however, I find that the key lies in how one views the obstacles in life and in investing. When it comes to investing, those obstacles are ‘uncertainty’ and ‘risk’. On one hand, the obstacles can be viewed as something to be avoided. On the other, it can be seen as an opportunity to be embraced.

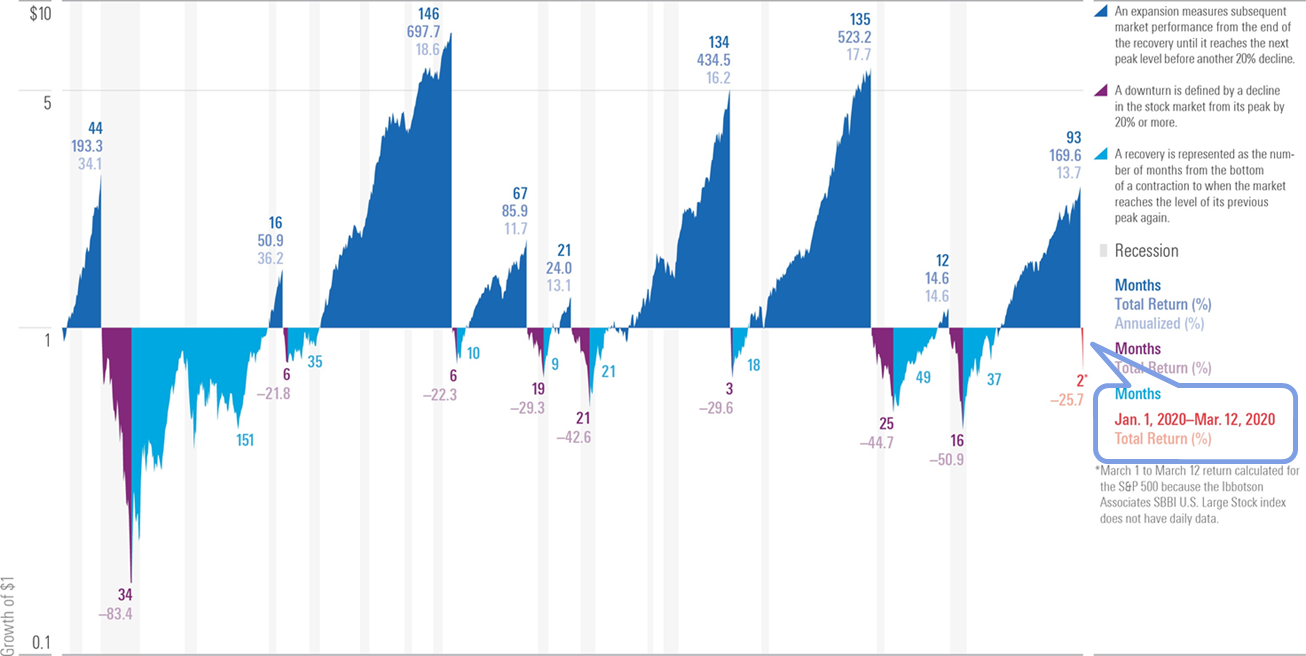

The graph below shows the downturns, recoveries, and expansions in the S&P 500 since 1926.

Source: Morningstar

Over the nearly 100-year period reflected in the chart, you will see that we’ve had several large downturns and recoveries. We’ve also had many smaller but significant fluctuations in between.

What we must accept is the fact that cycles like these are part of the normal functioning of markets. Throughout our lives, markets will rise and fall, just like the tides of the ocean. At times, that rise and fall will feel like a tsunami. When you are at the top of the market, it will feel wonderful. At the bottom, it will feel terrible. We can’t control these moments of euphoria and panic, but what we can do is control how we react to them.

I am reminded in this moment of the words of Marcus Aurelius, the great Roman Emperor.

“Our actions may be impeded…but there can be no impeding our intentions or dispositions. Because we can accommodate and adapt. The mind adapts and converts to its own purposes the obstacle to our acting. The impediment to action advances action. What stands in the way, becomes the way.”

So, rather than bemoaning our current situation and wasting mental energy on something that we cannot change, whether it be the loss of $300,000, or the struggles of this COVID- 19 pandemic, whether they be large or small, let’s instead turn the obstacle into an opportunity for action.

With that mindset, here’s a checklist for investors. Speak to your financial advisor and assess the following:

- How will this downturn affect your immediate, medium- and long-term goals?

- Have you been taking on more risk than you realize or even need?

- Can you turn this panic into an opportunity?

- Is this an opportunity to take some short-term tax losses and use it to offset past or future capital gains?

- Are there positions in your portfolio that you have been reluctant to sell because of tax consequences?

- Is this an opportunity to upgrade your portfolio by diversifying your investment style, market cap or geographic allocation?

It is perfectly natural for market turbulence to cause fear, but panic is not helpful. Volatility can be our friend if we’re ready to reassess which markets or assets are newly formed opportunities, and which ones remain fully valued so that we can trade accordingly. As I’ve said frequently, market volatility can serve investors well if it is viewed as a way to respond to opportunities. So, do as Emperor Aurelius said some 1,850 years ago: Turn every obstacle into an opportunity for action. These are wise words to remember when faced with any obstacle in life.

Markets and Economics

On the economic front, recent data out of Emerging Market Asian countries has shown some early signs of optimism. China’s manufacturing and export numbers for March showed some bounce back, which was supported by additional data from Korea, which reflected higher imports from China. Korea hasn’t been as hard hit by the COVID-19 crisis as many other countries. However, China’s bounce could be short-lived as demand for Chinese goods by G10 countries fades over the coming months due to the impact from social lockdowns.

Despite all the gloom, a good case can be made for equities on a two-year horizon, driven by a recovery in activity and the fiscal support put in place by governments. Critically, the way governments are seeking to help corporations will help reduce the negative effects of the current economic environment. Investors will need to return to equities for dividend income, capital growth, and to maintain their purchasing power. Historically, after a sharp contraction, we’ve seen markets bounce as activity returns. This current cycle, however, is quite different. At the onset of this crisis, inventories were low both in the U.S. and Europe and with the fiscal stimulus in place, there could potentially be a stronger recovery. The timing for that recovery, though, remains uncertain at this stage.

Last week, markets were relatively calm compared to the previous week, fluctuating within a range of +/-3% daily. The one exception was oil, which appreciated ~43% from its March 29 low on the back of President Trump’s phone call to President Putin, which may prove to be an important turning point in the standoff between Russia and Saudi Arabia that had sent oil prices tumbling. I am skeptical that an agreement can be reached to reduce oil production enough to offset the current weak demand. However, the rise in oil price benefited our Canadian equity mandates, which in turn helped our portfolios.

On Monday, markets were solidly positive throughout the day carried up by positive news that hard-hit countries in Europe, including Italy and Spain, reported a slowdown in new infections following strict containment measures, leading to speculation that lockdowns may be eased in a few weeks.

Still, markets are likely to remain turbulent. The degree of uncertainty is still very high, and investors will react strongly and swiftly to whatever is the latest news.

What we need to see going forward is a reinforcement of positive, or at least, less bad news. Given the high degree of uncertainty, investors need to balance the risks in their portfolios and avoid making the damaging mistake of either being too cautious or too aggressive during this time. Making either one of those mistakes could be extremely detrimental to the long-term health of your portfolio.

Looking Ahead

When we are finally looking at this pandemic through the rear-view mirror, we believe that high quality stocks and bonds issued by companies with access to ample financial resources will emerge in good shape and continue to deliver profits, cash flows, and dividends into the future. Many high-quality companies have been proactive in taking remedial steps to cut costs and preserve cash for rosier times ahead. While unhelpful for dividend distributions and income to investors over the short time horizon, these companies are helping to ensure that their future dividend-paying capability is preserved. This pandemic is an unprecedented event in our lifetime and, therefore, requires careful navigation to maximize opportunities while preserving capital.

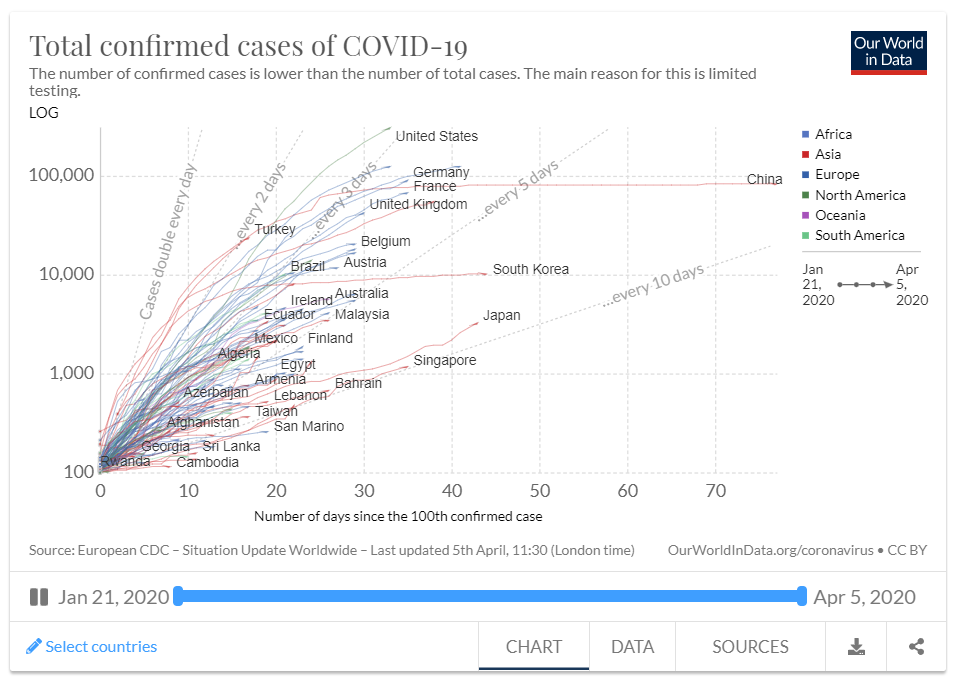

The key question at this time is how long it will take to contain COVID-19, allowing world economies to re-open. Italy’s virus data is being closely watched as any slowing in the infection rate will bolster hopes that the virus can be stopped independent of swift and effective government intervention. The chart below illustrates that cases globally have not yet peaked, so we believe that we have not seen the last of market volatility.

While much uncertainty still exists, governments have acted swiftly to try to counter some of the detrimental economic effects of the virus. There are concerted efforts around the world to ramp up virus testing capabilities and antibody kits to identify signs of immunity for those that may have already had the virus.

It is human nature to react strongly in this type of environment. Our underlying philosophy reminds us that our emotions often lead us to overreact. Extrapolating the current news flow long into the future is one such example. For our part, we are not waiting for good news, rather we are the evaluating the patterns of bad news and looking for those patterns to reduce. We don’t think that we are there yet, but we will be ready for it. Undoubtedly, investors’ patience will be wearing thin after the sharp stock market declines, however, once volatility steadies and visibility improves, investors’ focus will once again be on the underlying attractiveness of the prospects for individual companies. History suggests that our portfolios and investment specialists are very well placed to exploit the behavioral biases that have prevented stocks and bonds from being accurately assessed and valued. The heightened uncertainty accentuates our emotions and fears during such periods, making it very important to have a disciplined framework in place for investing.

What This Means to Our Portfolios

It’s impossible to pinpoint peaks and troughs. We don’t believe we have any special knowledge or skill to divine them, particularly in the short term. But we do have the discipline to buy assets when people fear most and sell the assets that are most beloved. Stocks will begin to recover long before the pandemic subsides. As noted, the strongest bull markets are not built on a foundation of good news, but on diminishing bad news.

Our portfolios have made it through the last few weeks reasonably well and last week was no exception. Cash levels are declining as our sub-advisors take advantage of the volatility and selectively purchase equities. We moved slightly out of our global fixed income position into high yield bonds and we will continue to do that systematically over the next several weeks. In the future, we will lighten up on some of our defensive positioning in the Strategic Portfolios, if and when we see markets retrace, and much of the worst news appears behind us. For now, our main risk mitigation strategies continue to do their job, having reduced their equity exposure throughout this period. As I’ve said since the beginning of this period, we know that now is the time when we must have courage, conviction and, most of all, patience. Today’s decisions will drive many years of future returns

Final Thoughts

My spouse, San Ng, is the Board Chair of Yee Hong Centre for Geriatric Care, Canada’s largest non-profit nursing home and community services organization, with 805 residents and 26,000 clients across the GTA. She made me aware of the tragedy that is brewing in across Canada with our most vulnerable citizens and those who care for them. As a result, Dr. Joseph Wong, Founder of Yee Hong and along with countless volunteers are raising funds through the Chinese Professionals Association of Canada to buy masks and other personal protective equipment (“PPE”) to support front line workers who are at risk of exposure each and every day. In partnership with the City of Toronto, the Regions of York and Peel and the United Way of Greater Toronto, the purchased PPE will be distributed to places where they are most needed and where they can create the most impact. If you are looking for an opportunity to make a direct impact within your community, please visit the Canada Helps COVID-19 Pandemic Response page:

https://www.canadahelps.org/en/donate-to-coronavirus-outbreak-response/

I leave you with this final thought. How are you turning your current obstacle upside down? For myself and my family, we are spending more time together doing things like cooking and baking. I am exercising more (my first try at a handstand push-up didn’t go so well, but the scrapes will heal and I will try again tomorrow) and I am finding a little more time to practice the guitar - not that I think it’s helping as this will be one obstacle with a long road ahead of it. I admit I haven’t tackled cleaning out the basement. That’s one obstacle that I haven’t turned upside down – yet. My advice: Don’t let this opportunity pass you by.

Until next week, stay safe and be well.

Corrado Tiralongo

Chief Investment Officer

Counsel Portfolio Services | IPC Private Wealth

Click Here to Read Our Forward Looking Statements Disclaimer