Advice that's

personal

Transform your financial future with the right personal advice.

We get to the heart of your tough questions

Our advisors take time to build deeper, more personal connections – with you and your family. It’s the X-factor that gives you the confidence to share your hopes and dreams, what drives and inspires you. So, regardless of how you choose to connect, we will get to the heart of your hard questions and tailor your plan to give you the answers you need.

The Value of Advice

Gain confidence about your financial future with the help of an IPC Advisor and discover the peace of mind that comes from personalized advice.

Read our eBook to learn more.

7 - 14

Years of Advice

15 +

Years of Advice

0

No Advice

4 - 6

Years of Advice

Source: Cirano Report: Econometric Models on the Value of Advice of a Financial Advisor.

The

Personal

Wealth

Management

Strategy

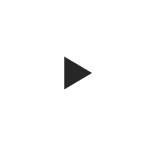

Our Advisors adopt a disciplined process using The Personal Wealth Management Strategy. This system allows them to examine all aspects of your financial well-being – from evaluating your current state to understanding your dreams and aspirations – to build the plan that's right for you.

6. PROGRESS REVIEW

Conduct annual reviews to ensure you’re on track to achieving your goals; adjust your plan to suit the changes in your life.

5. ESTATE TAX PLANNING

Develop a plan to ensure what you leave behind for your loved ones is efficiently transferred to them.

4. BANKING RELATIONSHIP REVIEW

Examine the relationships you have with your financial institution and identify ways to improve your banking services.

3. RISK MANAGEMENT REVIEW

Develop contingency plans and recommend insurance solutions to deal with the ups and downs of life along the road.

2. PORTFOLIO MANAGEMENT SYSTEM

Provide a portfolio that meets your investment objectives to help achieve your target returns.

1. DREAM PLAN

Understand how you want your money to work for you; evaluate your wants, needs and goals; map your plan.

- DREAM PLAN

Understand how you want your money to work for you; evaluate your wants, needs and goals; map your plan. - PORTFOLIO MANAGEMENT SYSTEM

Provide a portfolio that meets your investment objectives to help achieve your target returns. - RISK MANAGEMENT REVIEW

Develop contingency plans and recommend insurance solutions to deal with the ups and downs of life along the road. - BANKING RELATIONSHIP REVIEW

Develop a plan to ensure what you leave behind for your loved ones is efficiently transferred to them. - ESTATE TAX PLANNING

Provide a portfolio that meets your investment objectives to help achieve your target returns. - PROGRESS REVIEW

Develop a plan to ensure what you leave behind for your loved ones is efficiently transferred to them.

Get advice your way TM

Work with an IPC Advisor

Find out what an IPC Advisor can do for you.

There are no obligations, just possibilities