Life your way,

you've earned it.

Pay yourself back with the right retirement income planning advice.

What will you start in retirement?

We see retirement as a new beginning, with more time for new adventures, new ventures, new opportunities, and new ways to give back.

Yet, approaching retirement can feel unsettling, especially when you have unanswered questions about how your investments will support your lifestyle.

Take control of your retirement income

The right advice – from an advisor who truly knows you – can make all the difference.

Our advisors can answer your questions, give you advice and work with you to create a retirement income plan that targets your goals - so you can retire confidently.

If you're worrying about your retirement income, you're not alone.

70%

Looking out over the

next 10 - 15 years

of Canadians nearing retirement are worried about their retirement strategy

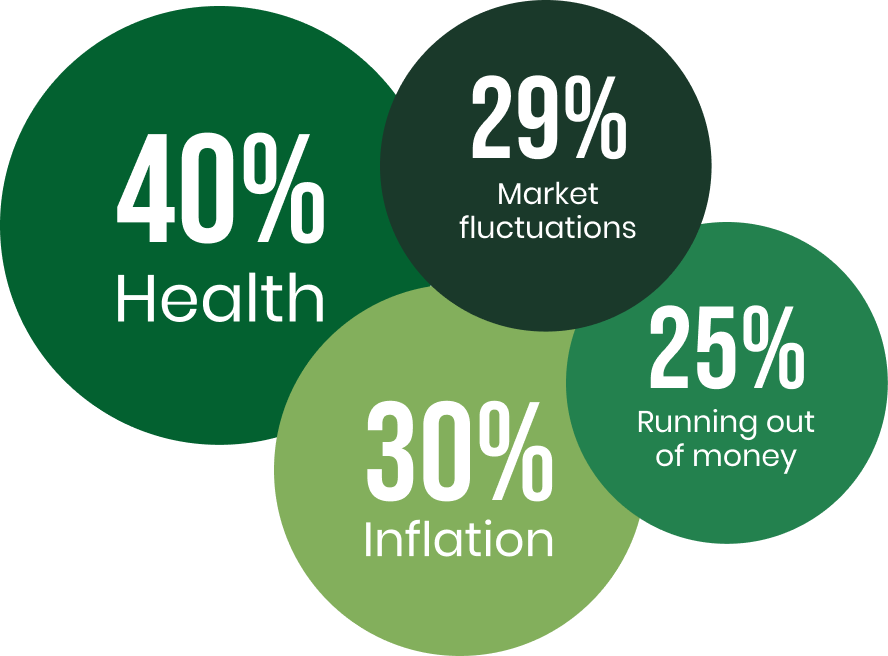

When thinking about their retirement income plan,

investors are most concerned about:

Expert guidance throughout your retirement

With comprehensive analysis and experience, our advisors can help you maximize your retirement income streams with the right combination of investment and risk management strategies.

With an IPC Advisor by your side, you have a partner-in-planning who will answer all your questions, including:

The right advice

How much do I need to retire?

How much you will need in retirement depends on various factors, including your age at retirement, desired retirement lifestyle and portfolio strategy, and expected returns.

What are the types of retirement income?

There are various possible sources of income that may impact your retirement savings. It’s important to understand each of your income sources, how much you can expect from them, and how the combination of your income streams will sustain you throughout retirement.

How will I draw income when I retire?

First, consider all your different income sources. Then design a plan that allows you to maximize the amount of income you withdraw from each source using the most effective and tax-efficient way possible.

How will my investment strategy change in retirement?

When moving from accumulating wealth to drawing income from your portfolios, your investment objectives and strategy will evolve. Retirement income portfolios place more emphasis on generating income for the short-term while growing and protecting capital over the longer term.

What factors influence my retirement income strategy?

There are various factors that can influence your income plan in retirement, including interest rates, how you time withdrawals, pension regulations or unexpected life events.

I couldn’t have made this significant change without Midori. I am all settled into my new apartment, and I have peace of mind that I can afford the additional costs that come along with being in a place like this – which means I can enjoy my time here.

Audrey J.

Julia’s planning helped us understand the benefits of addressing our retirement tax liabilities. It’s an area we had not considered before working with her. Overall, we believe this has saved us and our future estate tens of thousands of dollars.

Barry & Barb G.

Read Barry & Barb's story

Working with Doug has shown me how retirement has an emotional side as well as a financial side, and it’s important to take care of both.

Pauline D.

Dean showed me how all the different parts of my retirement income could fit together to meet my needs. I’ve been his client for more than ten years now, and I trust his advice completely. Before I started working with Dean, I thought that retirement was probably many years away for me. His know-how made my early retirement goal work!

Sarah

Life your way, you've earned it.