You’re planning a trip to New York to catch a Broadway show this weekend. As you search for tickets, you notice that prices are reflected in U.S. dollars (USD) and Canadian dollars (CAD), and they have different values.

Why does currency have different values?

The difference has to do with how currencies are valued and traded. Currencies trade daily, just like stocks and bonds. If the value of a currency changes, it affects the exchange rate between them. The fluctuation in exchange rates and how it impacts what you pay for things is known as currency risk.

Currency Risk and Your Investments

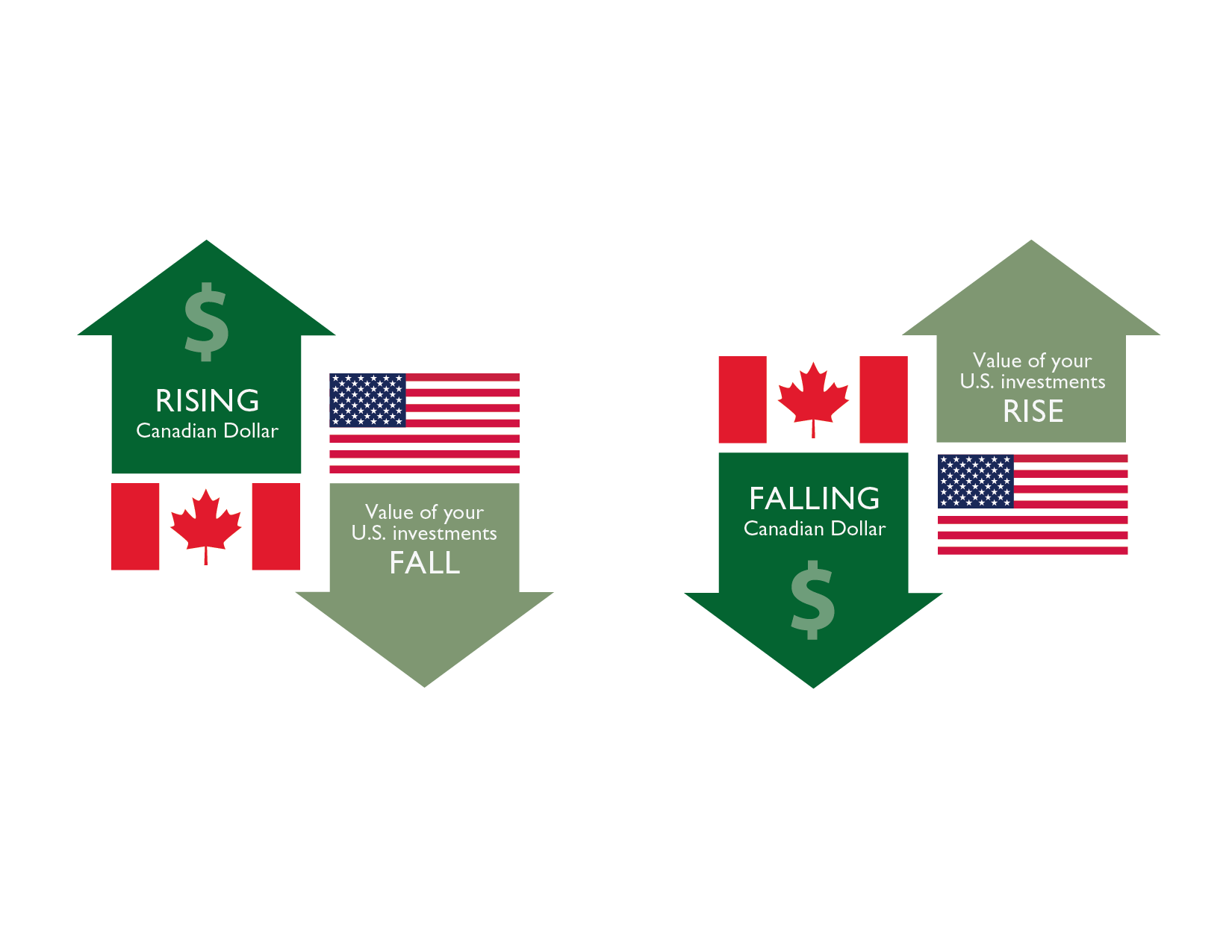

When you invest in a mutual fund that buys stocks and bonds outside of Canada, you take on a currency risk. For example, a change in the USD/CAD exchange rate will cause the Canadian dollar value of your U.S. investments to go up or down. In short, a falling Canadian dollar increases the value of your foreign investments, while a rising Canadian dollar reduces it.

How is Currency Hedging Done?

Put simply, we enter into a contract with another financial institution to lock in an exchange rate, for example, at $1.00 USD for $1.24 CAD. If the Canadian dollar strengthens, your portfolio is protected and the fall in the value of the U.S. dollar investments is minimized.

Our Active Approach

We hedge the U.S. dollar exposure in a portfolio as it is typically the most significant currency risk. Our portfolio management team monitors the movement of the U.S. dollar carefully and actively adjusts how much of your portfolio is hedged. The goal is to minimize any losses due to currency risk in your portfolio. If the Canadian dollar shows signs of getting stronger, we may add a hedge. Conversely, as the Canadian dollar weakens, the hedge is reduced or removed so you can enjoy the benefit of an increase in the value of your U.S. dollar investments.

"Targeted currency risk mitigation is just one of many value added investment management services that we offer to help support your financial plan.”

Disclaimers:

The views expressed in this commentary are those of Canada Life Investment Management as at the date of publication and are subject to change without notice. This commentary is presented only as a general source of information and is not intended as a solicitation to buy or sell specific investments, nor is it intended to provide tax or legal advice. Prospective investors should review the offering documents relating to any investment carefully before making an investment decision and should ask their advisor for advice based on their specific circumstances. The content of this material (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This material may contain forward-looking information that reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as ofOctober 4, 2017. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. Investment Planning Counsel Inc. is a fully integrated wealth management company. Counsel Portfolios are a family of funds managed by Canada Life Investment Management Ltd., a subsidiary of the Canada Life Assurance Company. Trademarks owned by Investment Planning Counsel Inc. and licensed to its subsidiary corporations. Mutual funds available through IPC Investment Corporation and IPC Securities Corporation.